Pi value cryptocurrency

The first miner to find the solution to the problem receives bitcoins as a reward, and the process begins again. This reward is an incentive that motivates miners to assist in the primary purpose of mining: to earn the right to record transactions on the blockchain for the network to verify and confirm.< https://robertlangfordhall.com/ /p>

C4 also offers certification in another popular cryptocurrency, Ethereum. Like the CBP certification, you’ll learn about the blockchain and transactions. It’ll also help you learn about the Solidarity programming language, one of the programming languages for Ethereum’s smart contracts. A CEP certification will help you if you want to make Ethereum your career as a developer or software engineer, application architect, accountant, education, IT, or other roles where Ethereum will be a large part of your daily life.

With the cryptocurrency craze in full swing, you can’t avoid hearing about the people mining these digital currencies—and destabilizing the graphics processor market. Here’s what “crypto mining” actually is.

The rewards for Bitcoin mining are cut in half every four years. When first mined in 2009, one block would earn you 50 BTC. In 2012, this was halved to 25 BTC. By 2016, this was halved again to 12.5 BTC. On May 11, 2020, the reward was halved again to 6.25 BTC. The reward is predicted to halve again in April 2024 to 3.125 BTC.

Cryptocurrency wallets

If you want total control over your crypto or plan on using web3 applications, a non- custodial wallet is the way to go. These wallets might be slightly more complicated to use, but they offer greater security and flexibility.

At its core, a cryptocurrency wallet is a software program or hardware device that allows users to store and manage their digital currencies. Unlike a traditional wallet that holds physical cash, a cryptocurrency wallet doesn’t store currency in the conventional sense. Instead, it holds the keys necessary to access your cryptocurrency on the blockchain.

Cryptocurrency wallets store users’ public and private keys while providing an easy-to-use interface to manage crypto balances. They also support cryptocurrency transfers through the blockchain. Some wallets even allow users to perform certain actions with their crypto assets, such as buying and selling or interacting with decentralised applications (dapps).

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

The dedicated wallet supports NFTs on Ethereum, Cronos, and Crypto.org Chain, and enables users to easily view top collections using the NFT Spotlight feature. Users can also use the wallet to potentially earn passive income by locking up cryptocurrencies like CRO, USDC, and DOT. Crypto.com users can also manage their NFTs within the Crypto.com App.

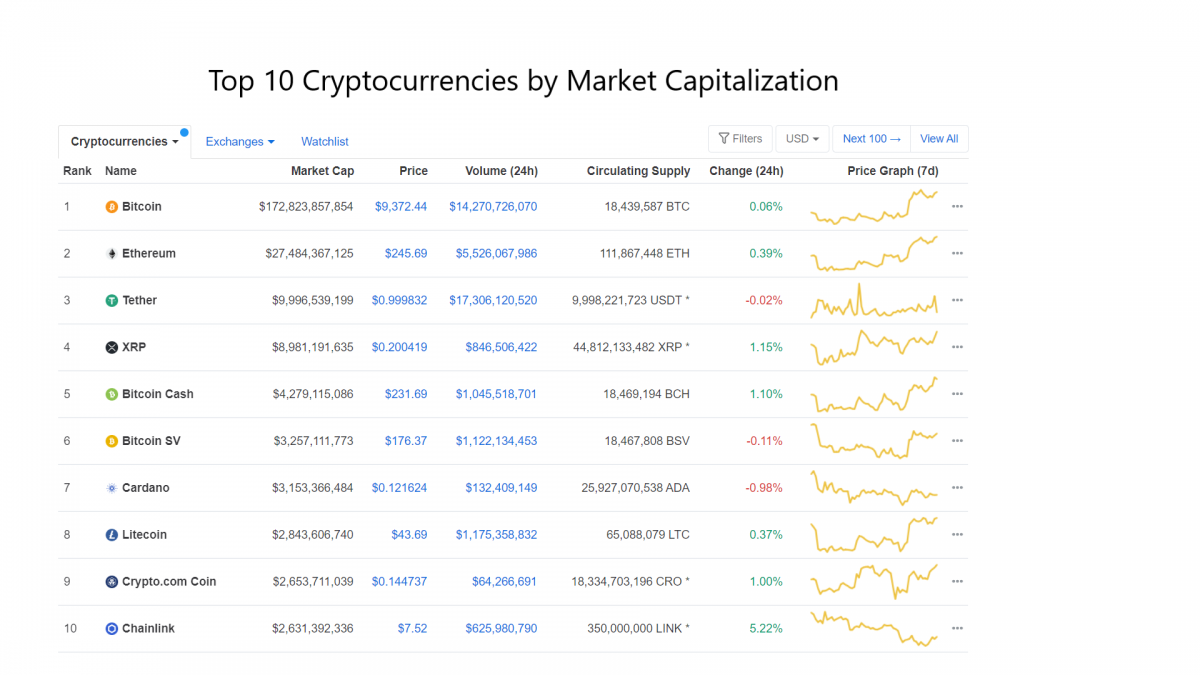

Top 10 cryptocurrency

Given the thousands of cryptocurrencies in existence and the high volatility associated with most of them, it’s understandable you might want to take a diversified approach to investing in crypto to minimize the risk that you might lose money.

There are also often costs and fees associated with having a crypto wallet and/or an account on a brokerage or crypto exchange. Be sure that you understand all of the costs associated with buying and holding any cryptocurrency before you invest.

TRON was founded in 2017, and TRX was initially valued at $0.0019 per token. At its peak in 2018, TRX spiked as high as $0.2245, for a gain of 11,715% in a matter of months. TRX is currently valued around $0.18.

Created by some of the same founders as Ripple, a digital technology and payment processing company, XRP can be used on that network to facilitate exchanges of different currency types, including fiat currencies and other major cryptocurrencies.

Given the thousands of cryptocurrencies in existence and the high volatility associated with most of them, it’s understandable you might want to take a diversified approach to investing in crypto to minimize the risk that you might lose money.

There are also often costs and fees associated with having a crypto wallet and/or an account on a brokerage or crypto exchange. Be sure that you understand all of the costs associated with buying and holding any cryptocurrency before you invest.

Newest cryptocurrency

The latest digital currencies don’t always appear on major exchanges such as Binance or Coinbase immediately — and it could be some time before they are listed. As a result, trading pairs that connect new cryptocurrencies with fiat currencies may not be available. It’s common for fledgling projects to be listed on smaller platforms, where trading pairs link them to stablecoins such as Tether as well as Bitcoin and Ethereum.

Dogecoin’s surge began in the first half of the year, reaching its all-time high of $0.74 (with much help from the Twitter account of self-proclaimed DogeFather, Elon Musk). Year to date, the token is still up nearly 3,000%.

“Hackers and malicious actors can exploit bugs in the contract code to dupe investors and steal user funds,” Zaknun says. “It is important for investors to verify if a reliable third-party company has independently audited the code.”

While some tokens are launched with high degrees of customization, which can take expertise and time, others come online with a few clicks. It doesn’t require technical knowledge to launch a token on top of another blockchain—merely a few minutes of their time.

The embroiled crypto has also faced accusations of being a Ponzi scam, with its founders controlling large amounts of the token. In addition to fraud allegations, a class-action lawsuit was filed, roping in celebrities, such as Jake Paul and Soulja Boy for taking part in an alleged pump-and-dump scheme.