Cryptocurrency prices

Een gereguleerde crypto exchange in Nederland. Begin bij een ervaren Nederlandse crypto exchange met een goede staat van diensten. In Nederland kun je eenvoudig, goedkoop en veilig met een iDEAL storting crypto´s verhandelen op het handelsplatform van Bitvavo in Amsterdam. can you take pictures in a casino Wanneer je zoekt naar meer handelsopties waaronder termijncontracten en hefbomen, dan zou je de Deribit exchange eens moeten evalueren.

Store and/or access information on a device. Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners (vendors)

Consider security, fees, and cryptocurrencies offered when researching crypto exchanges. It is also important to understand how your cryptocurrency is stored and whether you can take custody of that cryptocurrency by transferring itto your own digital wallet.

Selecting the right crypto exchange is vital for effective trading. Top choices like Binance, Kraken, KuCoin, Bitget, and Exolix excel in security, range of cryptocurrencies, and user experience. Bitcoin.com regularly updates its rankings, ensuring you have the latest information on the best platforms to meet your trading needs.

Centralized exchanges are the most common type of crypto exchange, where a central authority manages the platform. They offer high liquidity, a wide range of supported cryptocurrencies, and user-friendly interfaces. However, users must trust the exchange with their funds, which can be a security risk.

Cryptocurrency prices

The top cryptocurrencies refer to the most popular and highly valued coins in the market. These coins often lead in terms of market cap, technology, community engagement, and trading volume. They are often at the forefront of technological innovation, backed by robust security measures and supported by trustworthy teams.

While important, it’s essential to recognise that capitalisation isn’t the end-all-be-all. Other factors like trading volume, supply data, and technological development must also be considered for a well-rounded investment strategy.

The top cryptocurrencies refer to the most popular and highly valued coins in the market. These coins often lead in terms of market cap, technology, community engagement, and trading volume. They are often at the forefront of technological innovation, backed by robust security measures and supported by trustworthy teams.

While important, it’s essential to recognise that capitalisation isn’t the end-all-be-all. Other factors like trading volume, supply data, and technological development must also be considered for a well-rounded investment strategy.

Ripple (XRP): XRP specialises in swift and affordable cross-border transactions for banks and financial entities. Unlike Bitcoin and Ethereum, Ripple aims to revolutionise traditional banking by enabling real-time settlements, playing a vital role in global financial services.

On top of this, we have historical price data and detailed information explaining everything you need to know about the cryptocurrency’s price and the factors that influence it. Kriptomat allows you to set up an alert and receive a notification when the coin reaches a certain price.

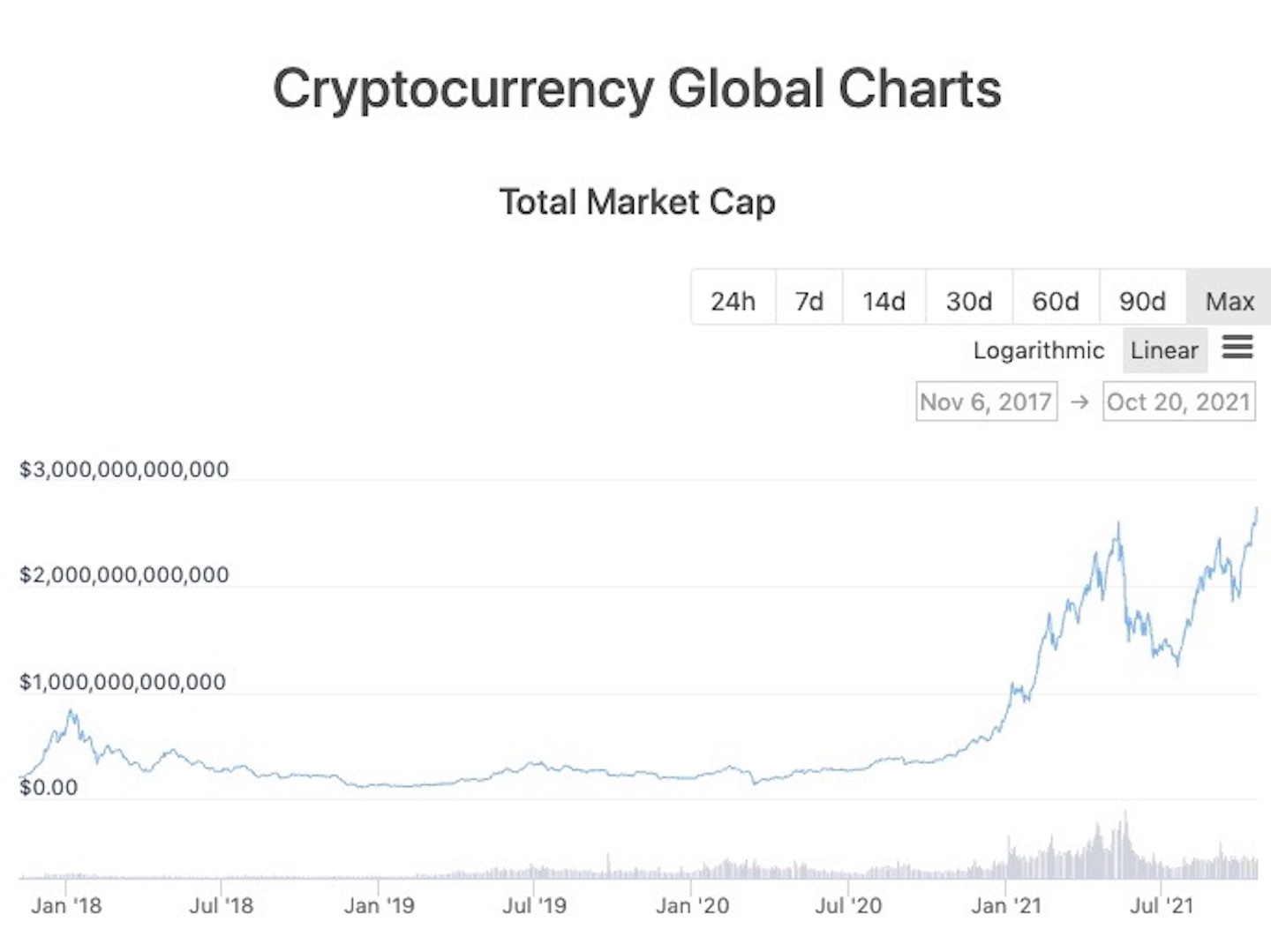

Cryptocurrency market cap

In 2022, RenBridge – an unregulated alternative to exchanges for transferring value between blockchains – was found to be responsible for the laundering of at least $540 million since 2020. It is especially popular with people attempting to launder money from theft. This includes a cyberattack on Japanese crypto exchange Liquid that has been linked to North Korea.

On 13 September 2018, Homero Josh Garza was sentenced to 21 months of imprisonment, followed by three years of supervised release. Garza had founded the cryptocurrency startups GAW Miners and ZenMiner in 2014, acknowledged in a plea agreement that the companies were part of a pyramid scheme, and pleaded guilty to wire fraud in 2015. The SEC separately brought a civil enforcement action in the US against Garza, who was eventually ordered to pay a judgment of $9.1 million plus $700,000 in interest. The SEC’s complaint stated that Garza, through his companies, had fraudulently sold “investment contracts representing shares in the profits they claimed would be generated” from mining.

The market capitalization of a cryptocurrency is calculated by multiplying the price by the number of coins in circulation. The total cryptocurrency market cap has historically been dominated by bitcoin accounting for at least 50% of the market cap value where altcoins have increased and decreased in market cap value in relation to bitcoin. Bitcoin’s value is largely determined by speculation among other technological limiting factors known as blockchain rewards coded into the architecture technology of bitcoin itself. The cryptocurrency market cap follows a trend known as the “halving”, which is when the block rewards received from bitcoin are halved due to technological mandated limited factors instilled into bitcoin which in turn limits the supply of bitcoin. As the date reaches near of a halving (twice thus far historically) the cryptocurrency market cap increases, followed by a downtrend.

In 2022, RenBridge – an unregulated alternative to exchanges for transferring value between blockchains – was found to be responsible for the laundering of at least $540 million since 2020. It is especially popular with people attempting to launder money from theft. This includes a cyberattack on Japanese crypto exchange Liquid that has been linked to North Korea.

On 13 September 2018, Homero Josh Garza was sentenced to 21 months of imprisonment, followed by three years of supervised release. Garza had founded the cryptocurrency startups GAW Miners and ZenMiner in 2014, acknowledged in a plea agreement that the companies were part of a pyramid scheme, and pleaded guilty to wire fraud in 2015. The SEC separately brought a civil enforcement action in the US against Garza, who was eventually ordered to pay a judgment of $9.1 million plus $700,000 in interest. The SEC’s complaint stated that Garza, through his companies, had fraudulently sold “investment contracts representing shares in the profits they claimed would be generated” from mining.

The market capitalization of a cryptocurrency is calculated by multiplying the price by the number of coins in circulation. The total cryptocurrency market cap has historically been dominated by bitcoin accounting for at least 50% of the market cap value where altcoins have increased and decreased in market cap value in relation to bitcoin. Bitcoin’s value is largely determined by speculation among other technological limiting factors known as blockchain rewards coded into the architecture technology of bitcoin itself. The cryptocurrency market cap follows a trend known as the “halving”, which is when the block rewards received from bitcoin are halved due to technological mandated limited factors instilled into bitcoin which in turn limits the supply of bitcoin. As the date reaches near of a halving (twice thus far historically) the cryptocurrency market cap increases, followed by a downtrend.